The 7-Second Trick For Business Debt Collection

Wiki Article

Top Guidelines Of Business Debt Collection

Table of ContentsBusiness Debt Collection for BeginnersThe Ultimate Guide To Dental Debt CollectionNot known Details About Business Debt Collection 3 Easy Facts About Debt Collection Agency DescribedThe Best Guide To Dental Debt Collection

The catch is that must the collector opt for less than the invoice quantity, the company's charge does not reduce. As an example, let's claim you bargain 25 percent of each billing will be kept by the collection business. If you have an invoice for $1,000, the firm's fee would certainly be $250.

This is the most hands-off method yet likewise calls for that the financial obligation collection agency take on one of the most run the risk of. Consequently, this version has a tendency to be the more costly choice. When a collection agency purchases your financial debts, they pay you a percent of the impressive billings. If you have $50,000 in unsettled invoices, a company might pay you $15,000 to purchase them from you and then proceed to function on collecting the unpaid quantities.

Employing a collection company may aid you recuperate lost earnings from uncollectable loans. Yet business should take care when working with a financial obligation collection company to make certain that they are correctly accredited, seasoned and also will represent your company well. Financial debt collection can be costly, however the quantity you obtain from overdue billings might be worth it

International Debt Collection - The Facts

Check your agreement for a termination stipulation. If not, contact the firm as well as directly work out such an arrangement. A discontinuation stipulation could allow you to break the agreement by paying a charge or offering notification within a details amount of time. There may be a target date in the contract by which time you can enact an escape condition if the company hasn't delivered.If they do not comply with with on vital points of the agreement, you might be able to damage the agreement. You can also just ask the business what their cancellation fee is.

The financial obligation collection market not just serves an essential function in recouping impressive debts owed to lenders and also service carriers, but it additionally offers a degree of self-confidence to loan providers to make credit score available to a large array of customers. This includes the bulk of interaction and collection activities linked with these accounts. The standing of put accounts within the originating lender's invoicing or collection systems need to indicate that the account is closed/placed.

The Facts About International Debt Collection Revealed

Now, the creditor can cross out the debt as a balance dues property on their annual report because the account is unlikely to be paid. The financial institution's equilibrium sheet looks better, yet the creditor still keeps the ability to collect on a superior property. Collection agencies work on behalf of the coming from financial institutions and try to recuperate unsettled equilibriums by getting to out to the customer using mail and also telephone.Agents try to get consumers on the phone to make payment plans with them, either as a lump sum to fix the account or with a collection of reoccuring settlements (debt collection agency). Collection agencies generally receive a commission percent on the quantity of cash they efficiently collect. This commission can differ by the age, equilibrium, kind and also the variety of times the account has actually been formerly worked, among others

Consequently, later stage collections more information often tend to have a greater compensation rate, due to the fact that less accounts are likely to pay. The bottom line is the bottom buck. When a creditor analyzes whether to proceed inner recuperation efforts versus outsourcing collections to a 3rd party supplier, the creditor must have a strong grip of the estimated net return of each technique and contrast that versus the price of paying payment versus the price of running an extremely specialized, intensely educated team of consumer assistance professionals.

5 Easy Facts About Debt Collection Agency Described

Explore our suite of options for financial institutions and how our third party vendor management can aid you.

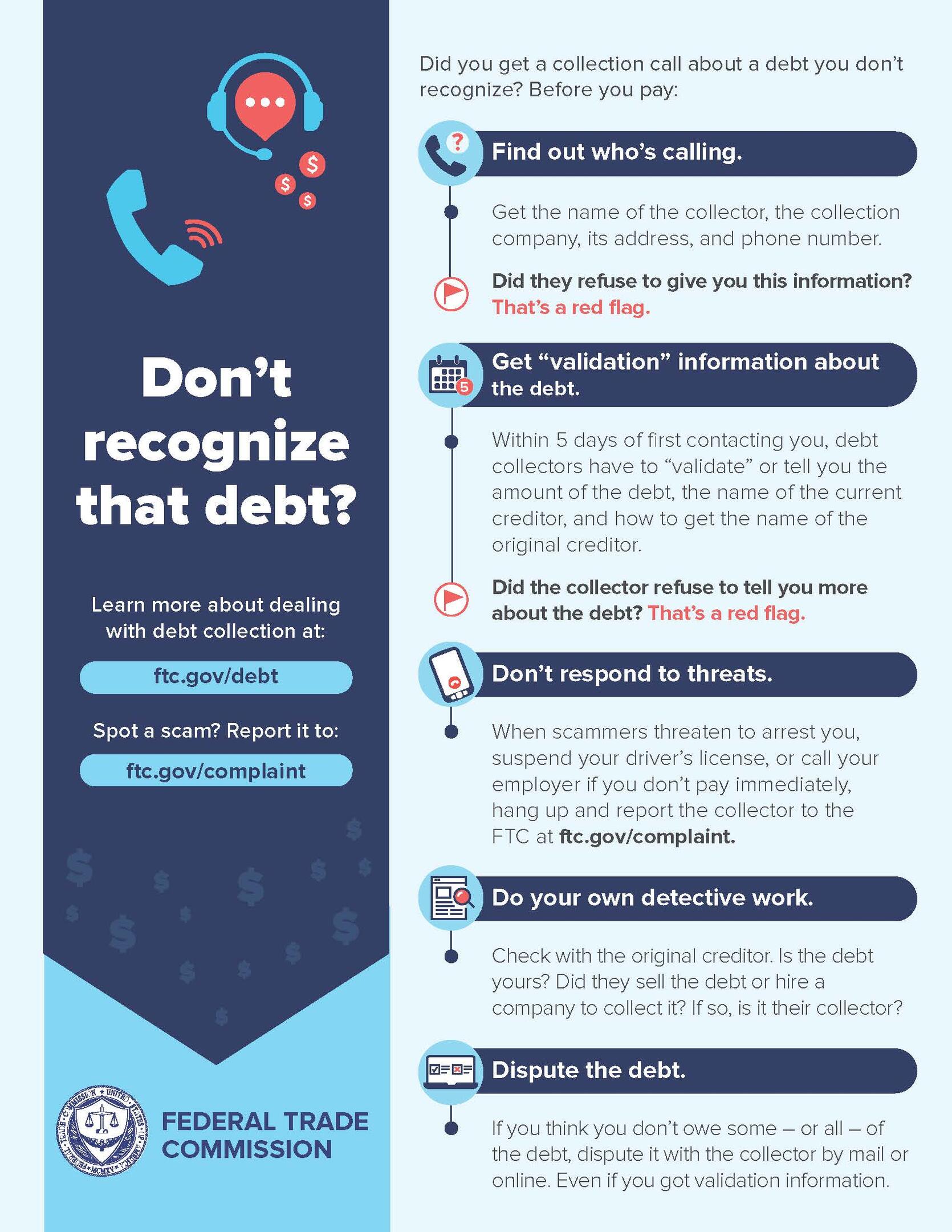

A roommate tells you a financial debt enthusiast called asking for you. That exact same financial obligation collector has left messages with your family, at your workplace, and also maintains calling you early in the morning and also late at evening.

There are federal and District of Columbia laws that shield consumers and also restrict financial debt collection agencies from using particular techniques that may be violent, unjust, or deceitful to consumers. Under these regulations, there are steps that you can require to limit a financial debt enthusiast's contact with you or to get more information he has a good point concerning the financial obligation enthusiast's insurance claim.

Report this wiki page